- August 13, 2024

- Suraj Tambe

- 0

NetSuite PayPal Integration in 2024: All You Should Know

Each business owner wants their business to thrive and bring in floods of orders each day. But, is it really possible to keep your business well organized and running seamlessly even at peak? Well, obviously not without having an optimized system in place that manages payments, reconciles accounts, and ensures that every transaction is accurately recorded.

As your business scales, such repetitive tasks can become overwhelming, leading to delays unfulfilled commitments, and overall customer dissatisfaction. This is where our superhero NetSuite PayPal integration comes into play. Keep reading to understand how you can benefit from this solution.

What Exactly is NetSuite PayPal Integration?

Integrating two platforms in the simplest terms means “connecting” two platforms to each other. So by NetSuite PayPal Integration, we mean connecting your NetSuite ERP with PayPal to sort out all your business transactions and provide a smoother checkout process to your customers.

This integration is like your “transactional stenographer” that records and collects all financial data from your PayPal transactions and constantly updates these into your NetSuite ERP. So basically, your personal digital bookkeeper who ensures that all your PayPal transactions are recorded within NetSuite without any hiccups.

This integration greatly cuts down manual labor and reduces any chances of transactional discrepancies or recording errors which benefits e-commerce businesses to a great extent.

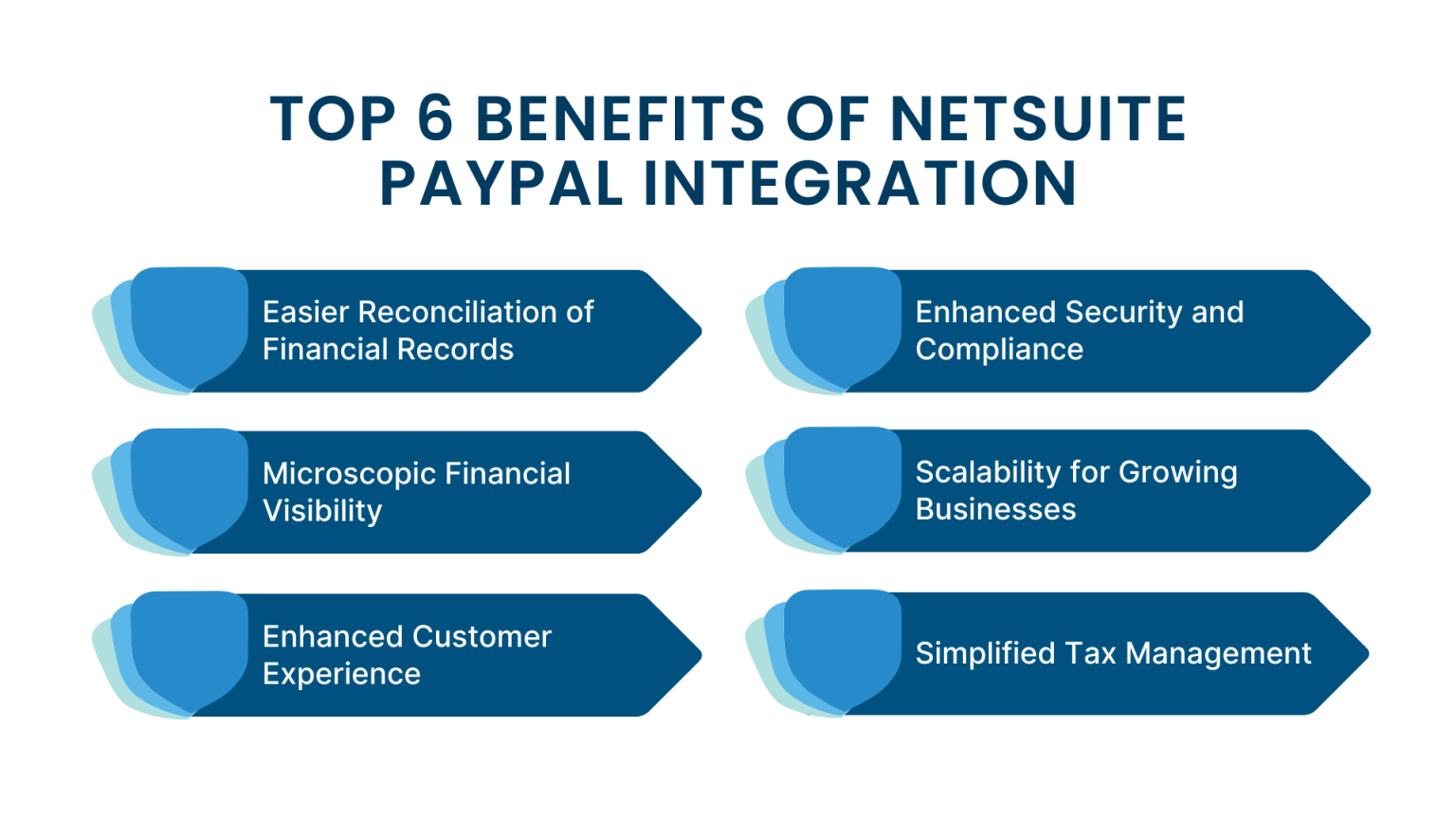

Top 6 Benefits of NetSuite PayPal Integration

So now you might be wondering, “managing and recording financial transactions” is this the only benefit of this integration thingy? - Not! In this section, we will dive deeper into all the nitty-gritty benefits of this integration.

1. Easier Reconciliation of Financial Records

As we have already discussed, reconciliation of business records after NetSuite PayPal Integration is the biggest benefit and use of this integration. We still stand by this as keeping a record of transactions be it a sale, fee, or refund, is a repetitive and error-prone process. If done manually, it can cost businesses hundreds of hours and multiple resources.

2. Microscopic Financial Visibility

NetSuite PayPal Integration allows you to monitor key business metrics like your cash flow, revenue, and expenses with ease. This kind of microscopic financial visibility allows you to quickly identify trends, spot any potential issues, and make proactive decisions that benefit you vastly.

3. Enhanced Customer Experience

NetSuite PayPal integration greatly simplifies and speeds up payment processing. By providing such an uncomplicated checkout process, your customer experience is greatly enhanced. This further provides a huge decrease in cart abandonment ratios!

According to a recent survey , it was proved that on average, approximately 46% of users who preferred to pay via a digital wallet such as PayPal, would abandon a purchase if they could not use a digital wallet option to process their payment on a merchant's website.

4. Enhanced Security and Compliance

PayPal’s secure, PCI-DSS-compliant gateway combined with NetSuite’s intact security and compliance policies provide a secure environment for your business. This integration, in turn, simplifies audits and compliance with financial regulations.

5. Scalability for Growing Businesses

Whether you are processing a few transactions an hour or face great ordering volumes, PayPal NetSuite Integration will always benefit you in the long term. As your e-commerce operations grow year on year, this PayPal NetSuite integration will help you maintain data sanity and reliability.

6. Simplified Tax Management

NetSuite automates the process of applying tax rules to all transactions with its built-in tax logic. So maintaining tax compliance becomes a walk in the park. By keeping your tax records compliant and accurate, PayPal NetSuite integration reduces the risk of errors and penalties saving your business some serious bucks!

Comprehensive Guide to NetSuite PayPal Integration

We know it sounds extremely complicated to Integrate Netsuite with PayPal. But, if you try and follow the right steps, we promise it becomes a million times easier.

Step 1. Prepare Your NetSuite and PayPal Accounts

Ensure you have active accounts on both the platforms NetSuite and PayPal for NetSuite PayPal Integration. If you do not have active accounts, sign up and create these accounts. Ensure that your PayPal Professional/Business account is now transaction-ready and that you have input all necessary documents and business data.

Step 2. Enable SuitePayments

NetSuite’s SuitePayments is an essential tool for payment processing. Ensure that SuitePayments is enabled via your NetSuite account settings. Once enabled, this feature is how you connect various payment gateways like PayPal to your NetSuite account.

Step 3. Install the PayPal Integration Bundle

Open the official NetSuite’s SuiteApp Marketplace and search for the PayPal integration bundle. Once found, click on the “Download and Install” options to install and run this bundle in your NetSuite account. This bundle contains all the necessary scripts and configurations required for this PayPal NetSuite integration.

Step 4. Configure the Integration

Once the bundle is successfully installed, go to the PayPal configuration page in NetSuite. NetSuite will then ask you to input your PayPal API credentials. This will include your API username, password, and signature, etc. These credentials are the bridge to how NetSuite communicates with your PayPal account.

Step 5. Map Accounts

The next step is to map your PayPal sales, fees, and refund accounts to the appropriate general ledger accounts in NetSuite ERP. This step will ensure that all types of transactions within PayPal are securely recorded in NetSuite.

Step 6. Set Up Automated Reconciliation

Once you are done mapping your accounts, you can set up automated rules that match PayPal transactions with corresponding records in NetSuite ERP. This majorly serves as a key benefit of NetSuite PayPal Integration ensuring automated reconciliation and error reduction.

Step 7. Test the Integration

So you have done all this work and now you don’t want to mess your site up by going live without proper testing. Testing the integration settings in an offline environment is really important.

To do this, Run a few dummy transactions through PayPal to test if they are accurately recorded in NetSuite. Ensure correctness of the NetSuite PayPal Integration by paying attention to all the details such as the amounts, dates, fees, tax rules application, etc.

Step 8. Go Live

So now, your NetSuite PayPal integration is completed and these changes are ready to go live. So just press the trigger and watch your system work in real-time.

Step 9. Monitor and Optimize

Once the integration is done, constant monitoring and optimization are crucial to keep the system working smoothly. As you go about monitoring and exploring the system, stay updated with the latest feature changes and ensure you optimize your NetSuite regularly.