- July 26, 2023

- LiveStrong Technologies

- 0

NetSuite Planning and Budgeting for Small Businesses: Is It Worth It?

Understanding Planning and Budgeting for Small Businesses

As a small business owner, you know that planning and budgeting are the cornerstones of financial success. Budgets help you allocate resources efficiently, plan, and track progress. However, managing financials manually can be time-consuming and prone to errors, especially as your business grows. This is where modern financial planning and budgeting software comes to the rescue.

The Importance of Effective Financial Management

Before diving into the world of NetSuite Planning and Budgeting, let's underscore the importance of effective financial management for small businesses. Proper planning and budgeting offer several benefits, such as:

1. Better Decision Making:

Accurate financial data helps you make informed decisions, whether it's about launching a new product line or expanding to new markets.

2. Resource Allocation:

Budgets ensure that resources are allocated wisely, preventing overspending and promoting financial stability.

3. Goal Setting and Measurement:

Financial planning allows you to set realistic goals and track your progress toward achieving them.

4. Risk Management:

By forecasting potential financial challenges, you can proactively address risks and safeguard your business.

Exploring NetSuite Planning and Budgeting

What is NetSuite?

NetSuite, a product of Oracle Corporation, is a cloud-based enterprise resource planning (ERP) software suite that empowers businesses with a comprehensive range of financial management tools. From accounting and inventory management to customer relationship management (CRM) and beyond, NetSuite offers an integrated platform that streamlines operations, enhances visibility, and drives growth.

An Overview of NetSuite Planning and Budgeting

NetSuite Planning and Budgeting, formerly known as NetSuite Planning, Budgeting, and Forecasting (PBF), is a specialized module within the NetSuite ERP ecosystem. It's designed to simplify the budgeting and forecasting process, enabling businesses to create, review, and adjust budgets with ease. The main characteristics of NetSuite Planning and Budgeting consist of.

1. Centralized Budget Repository:

All budget-related data is stored in a centralized location, promoting collaboration and eliminating version control issues.

2. Real-time Analytics:

The system provides real-time insights into financial data, allowing stakeholders to make data-driven decisions promptly.

3. Flexible Modeling:

Businesses can create "what-if" scenarios and model different budgeting scenarios to evaluate potential outcomes.

4. Automated Workflows:

NetSuite automates repetitive tasks, such as data entry and consolidation, freeing up time for more strategic activities.

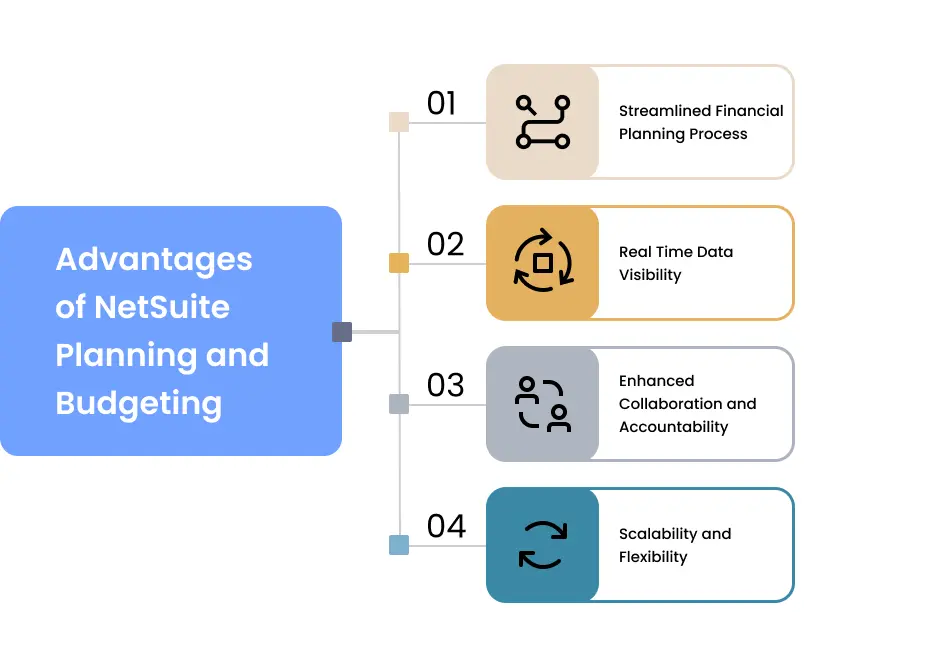

Advantages of NetSuite Planning and Budgeting

Streamlined Financial Planning Process

Gone are the days of using countless spreadsheets for budgeting. NetSuite Planning and Budgeting streamline the entire process, making it more efficient and accurate. The advantages of this streamlined approach include:

1. Time Savings:

With automated data entry and consolidation, finance teams can reallocate their time to more value-adding tasks.

2. Reduced Errors:

Manual data handling is prone to errors, whereas NetSuite's automation minimizes the risk of mistakes in the budgeting process.

3. Version Control:

Collaborative budgeting ensures that everyone is working on the latest version, eliminating versioning confusion.

Real-time Data Visibility

As a small business owner, having real-time visibility into your financials is invaluable. NetSuite Planning and Budgeting offers this advantage, allowing you to:

1. Monitor Performance:

Keep a close eye on your business's financial health and performance at any given moment.

2. Identify Trends:

Quickly identify positive or negative financial trends, enabling proactive adjustments to your budget strategy.

3. Spot Opportunities and Risks:

Timely access to financial data helps you identify new opportunities or potential risks before they become critical.

Enhanced Collaboration and Accountability

NetSuite Planning and Budgeting foster collaboration and accountability among team members. This is achieved through:

1. Centralized Access:

Team members can access the budgeting data from anywhere, making remote collaboration seamless.

2. Role-based Permissions:

Control access to sensitive financial data based on team members' roles, ensuring data security.

3. Task Assignments:

Assign specific budgeting tasks to individuals, creating clear accountability for each stage of the process.

Scalability and Flexibility

Small businesses often experience growth and changes in their operations. NetSuite Planning and Budgeting provides scalability and flexibility to adapt to these changes:

1. Easily Accommodate Growth:

As your business grows, NetSuite can scale to meet your increasing budgeting needs.

2. Restructuring Made Simple:

If you undergo organizational changes, NetSuite can accommodate restructuring in your budgeting process.

Changing Business Models:

Whether you shift your business model or add new product lines, NetSuite adapts accordingly.

Implementing NetSuite Planning and Budgeting

Assessing Your Business Needs

Before jumping into implementing NetSuite Planning and Budgeting, it's essential to assess your business's specific requirements. Consider the following:

1. Current Budgeting Process:

Identify pain points in your existing budgeting process and outline the improvements you expect from NetSuite.

2. Integration Requirements:

Evaluate your existing systems and determine if NetSuite needs to integrate with other tools.

Choosing the Right NetSuite Plan

NetSuite offers different plans with varying features. Choosing the right plan is crucial for maximizing the benefits of NetSuite Planning and Budgeting. Factors to consider include:

1. Budgeting Complexity:

Assess the complexity of your budgeting process and choose a plan that caters to your needs.

2. Scalability:

If you anticipate growth, opt for a plan that can scale along with your business.

3. Additional Features:

Consider other features offered in the plan, such as CRM and inventory management, which may complement your business needs.

Data Migration and Integration

The process of moving your existing budgeting data to NetSuite is critical to a successful implementation. Follow these steps to ensure a seamless migration:

1. Data Cleaning:

Ensure your existing data is accurate and up to date before importing it into NetSuite.

2. Integration with Existing Systems:

If you're integrating NetSuite with other tools, validate that the data flows seamlessly between systems.

3. Testing and Validation:

Thoroughly test the migrated data to confirm its accuracy and reliability.

Training and Support

To ensure a successful adoption of NetSuite Planning and Budgeting, invest in comprehensive training for your team:

1. User Training:

Train your finance team and other stakeholders on how to use NetSuite for budgeting and forecasting effectively.

2. Ongoing Support:

Provide continuous support and resources to help users overcome challenges and get the most out of the software.

3. Leveraging Vendor Support:

Utilize NetSuite's support resources to resolve any technical issues that may arise.

Common Challenges and How to Overcome Them

Implementing NetSuite Planning and Budgeting may not be without its challenges. Let's explore some common hurdles and how to overcome them.

Initial Implementation Hurdles

1. Complexity:

The initial setup may seem overwhelming. Engage with NetSuite experts or consultants to guide you through the process.

2. Data Migration:

Migrating data from legacy systems requires careful planning and testing. Allow sufficient time for this step to avoid data discrepancies.

User Adoption and Training Challenges

1. Resistance to Change:

Some team members may resist adopting new software. Offer training sessions and emphasize the benefits of encouraging buy-in.

2 .Continuous Training:

Budgeting processes may evolve over time. Provide ongoing training to keep users updated on new features and best practices.

Customization Complexity

1. Tailoring to Business Needs:

NetSuite is highly customizable but avoids over-complicating the system. Focus on essential customizations that align with your specific needs.

2. Work with Experts:

Rely on NetSuite specialists or your internal IT team to ensure customizations are done efficiently and without disrupting core functionality.

Managing Ongoing Costs

1. License Management:

Keep track of user licenses and adjust them as your team size changes to avoid unnecessary expenses.

2. Review Usage:

Regularly review your NetSuite usage to ensure you're utilizing the software to its fullest potential and identify any cost-saving opportunities.

Is NetSuite Planning and Budgeting Worth It for Your Small Business?

Deciding whether NetSuite Planning and Budgeting is worth the investment requires a thorough evaluation. Consider the following steps:

Evaluating the Return on Investment (ROI)

1. Cost-Benefit Analysis:

Compare the upfront and ongoing costs of NetSuite with the potential benefits it offers, such as time savings, increased accuracy, and improved decision-making.

2. ROI Calculation:

Calculate the potential ROI based on the expected efficiency gains and financial improvements.

Considering Alternatives

1. Other Budgeting Software:

Explore other budgeting and forecasting software options to compare features and pricing.

2. Manual Processes:

Weigh the benefits of NetSuite against continuing with manual budgeting processes.

Making an Informed Decision

1. Seek Expert Opinions:

Consult with financial experts or business advisors who have experience with NetSuite or similar tools.

2. Pilot Testing:

Consider a pilot implementation to test NetSuite Planning and Budgeting's suitability for your business before committing to a full-scale rollout.

Conclusion

In conclusion, effective planning and budgeting are essential for small businesses to thrive. NetSuite Planning and Budgeting can significantly enhance financial management processes, providing real-time data visibility, streamlining collaboration, and offering scalability. By understanding your business needs, choosing the right plan, and investing in proper training, you can overcome challenges and maximize the benefits of NetSuite.

Ultimately, the decision to adopt NetSuite Planning and Budgeting depends on your business's unique requirements and the potential ROI it can deliver. With successful implementation and user adoption, NetSuite can be a game-changer for your small business's financial success.

FAQ

The implementation timeline depends on factors such as the complexity of your budgeting processes, data migration requirements, and the size of your business. On average, it may take anywhere from a few weeks to a few months. Proper planning and engaging with NetSuite experts can expedite the process.

Yes, NetSuite is designed to integrate with various third-party applications and tools. It can seamlessly connect with CRM systems, HR software, e-commerce platforms, and more. Integration allows for a holistic view of your business data and streamlines processes.

Absolutely! While it offers significant advantages for small businesses, NetSuite is designed to cater to the needs of enterprises of all sizes. Its scalability and flexibility make it a suitable choice for larger organizations with complex budgeting requirements.

NetSuite offers ongoing support through its customer service and support teams. You can access help resources, documentation, and training materials through their website. Additionally, NetSuite users may have access to regular software updates and enhancements.

Yes, NetSuite typically offers a trial period where you can explore the software’s features and functionalities. This trial allows you to assess how well NetSuite aligns with your business needs and make an informed decision before making a purchase.

Level up your business finances with NetSuite Planning and Budgeting! Gain real-time insights and streamline your budgeting process for better growth. #call to action Plan your NetSuite Today!